|

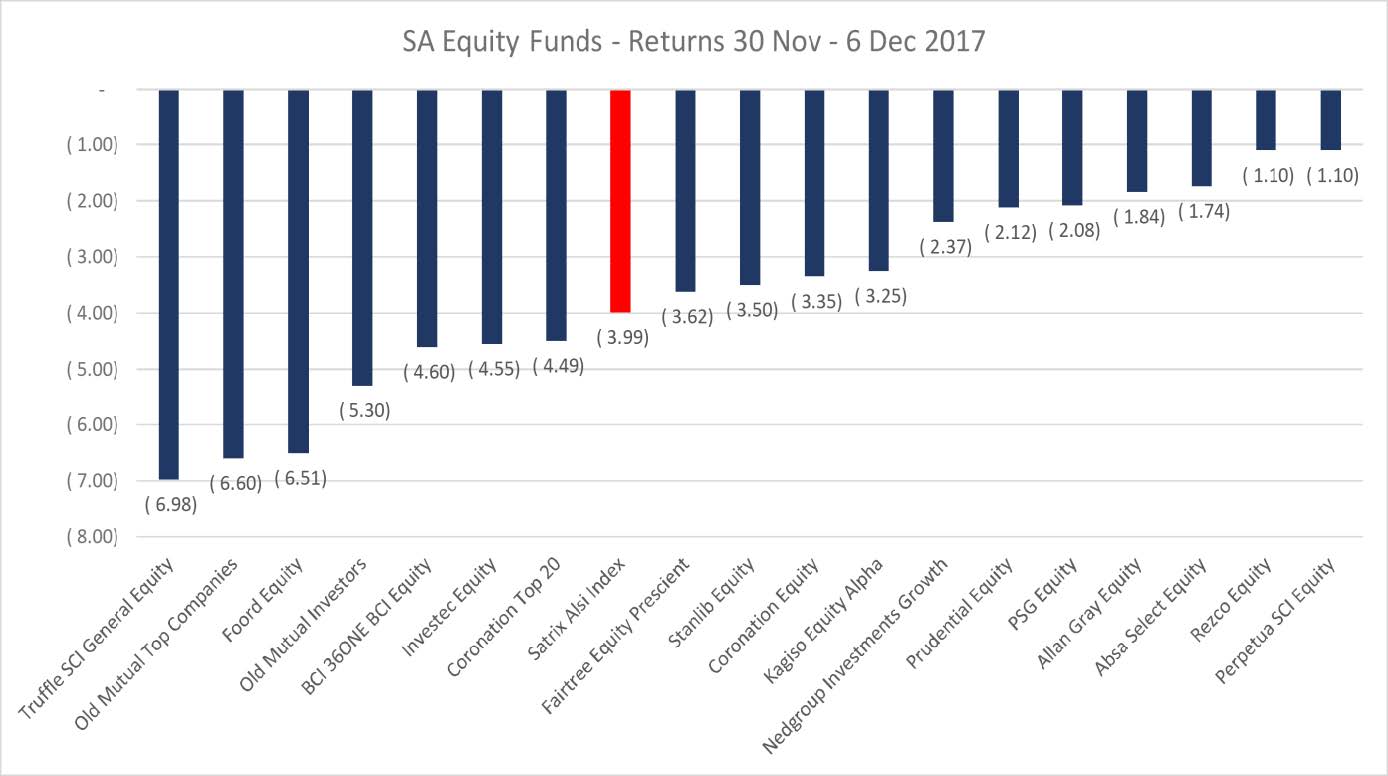

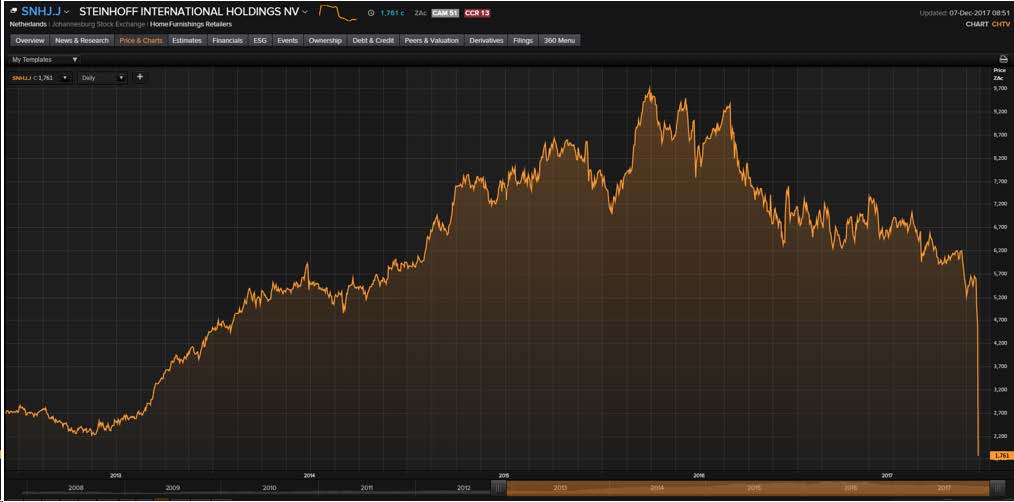

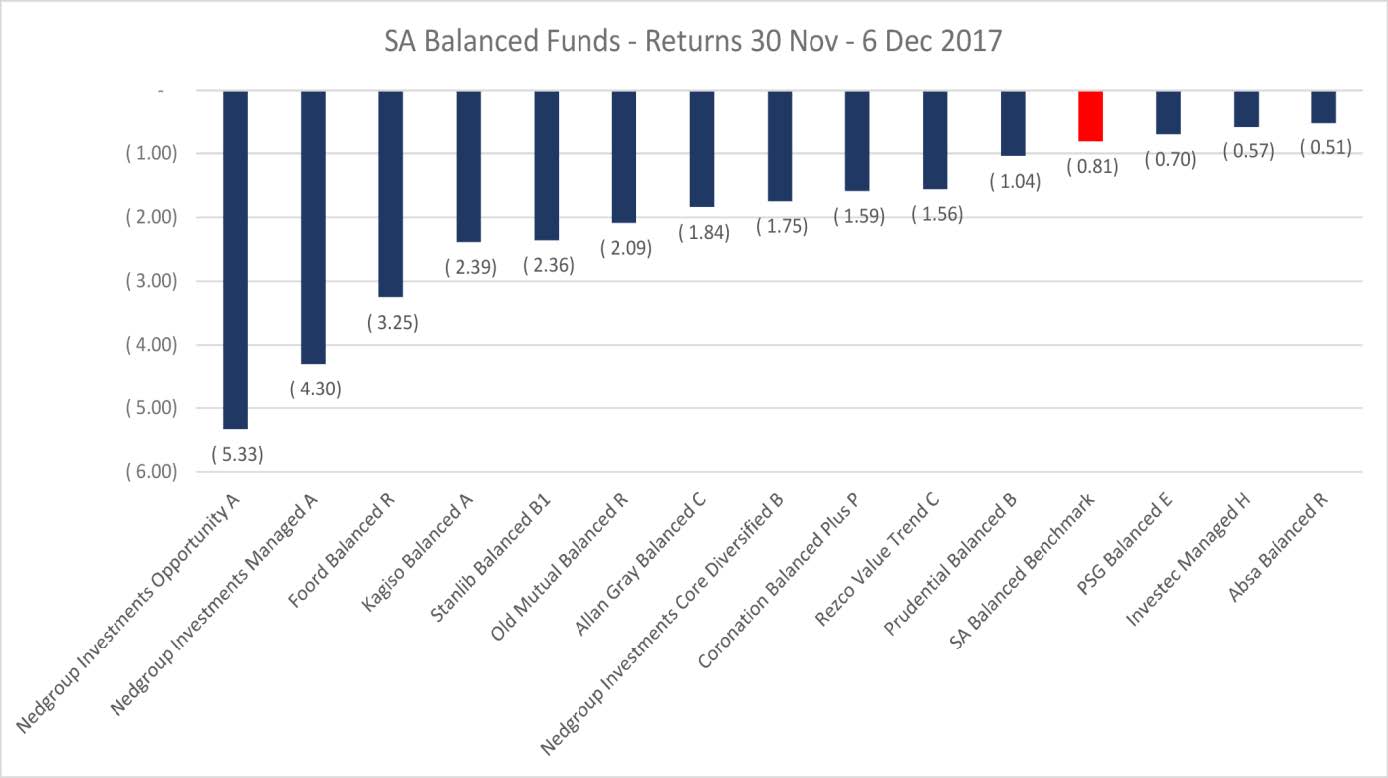

Yesterday’s surprise news around financial accounting irregularities within Steinhoff has resulted in a 60% drop in the share price on the day, which makes the fall 82% off its highs in 2016. It is not yet clear what the real ramifications of this event will mean for the share, however with it being widely held across local managers we have assessed the impact across client portfolios given what has happened so far. Naspers has also come off around 15% from its highs over the past few days so this is also likely to have an impact on shorter term returns given the magnitude of its holding across funds, bearing in mind Naspers is still up 64% year to date. Figure 1: Steinhoff share price history The primary local equity managers who have felt the effects of these two downward moves have been Foord, Coronation Top 20 (also holds INTU which was up 25% on the day which part offsets the Steinhoff drop), Old Mutual (Investors, Top Companies), ABAX (Rainmaker, Opportunity) and Truffle. Managers who have fared the best include Perpetua, Allan Gray, Rezco with minimal drawdowns. Within the multi-asset balanced funds which hold the highest proportion of local savings, Nedgroup Managed/Balanced, Foord and Kagiso have had more significant drawdowns although most funds are weaker as a result of the strong currency playing a broader role in these funds over the past few weeks. In the medium equity space, Nedgroup Opportunity has a significant holding to Steinhoff and as a result has experienced a significant drawdown which would be a large disappointment to them given their risk management process. SA Equity Funds  SA Multi-asset Balanced Funds Overall, client portfolios and their longer term objectives will be largely unaffected with respect to these events and encouragingly, there has been strong alignment between how we perceive risk management within each fund manager, to how we have added to the blended model portfolios with the exception of ABAX. This has resulted in a net good outcome for clients from an event which has the potential to incur permanent loss of capital – the worst-case outcome for any asset manager.

The upcoming ANC conference is an additional event which may cause volatility in returns, particularly with respect to local ‘SA Inc’ shares, bonds and the currency. We have spent considerable time evaluating the risk/return trade off here and are comfortable that portfolios being defensively positioned remains an appropriate position at this point. Going forward we will be monitoring the outcome of these events but for the foreseeable future do not see any action being necessary.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

February 2019

Categories |

RSS Feed

RSS Feed