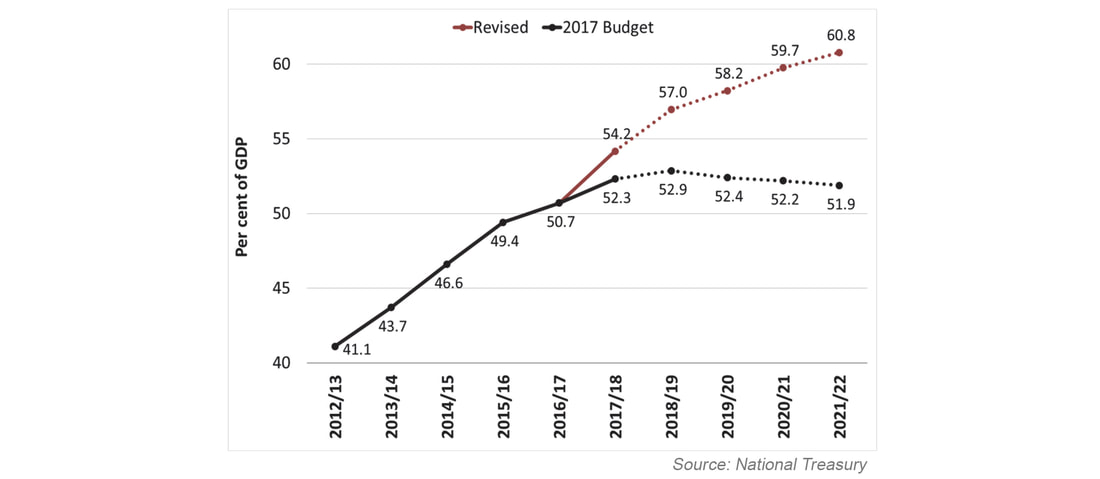

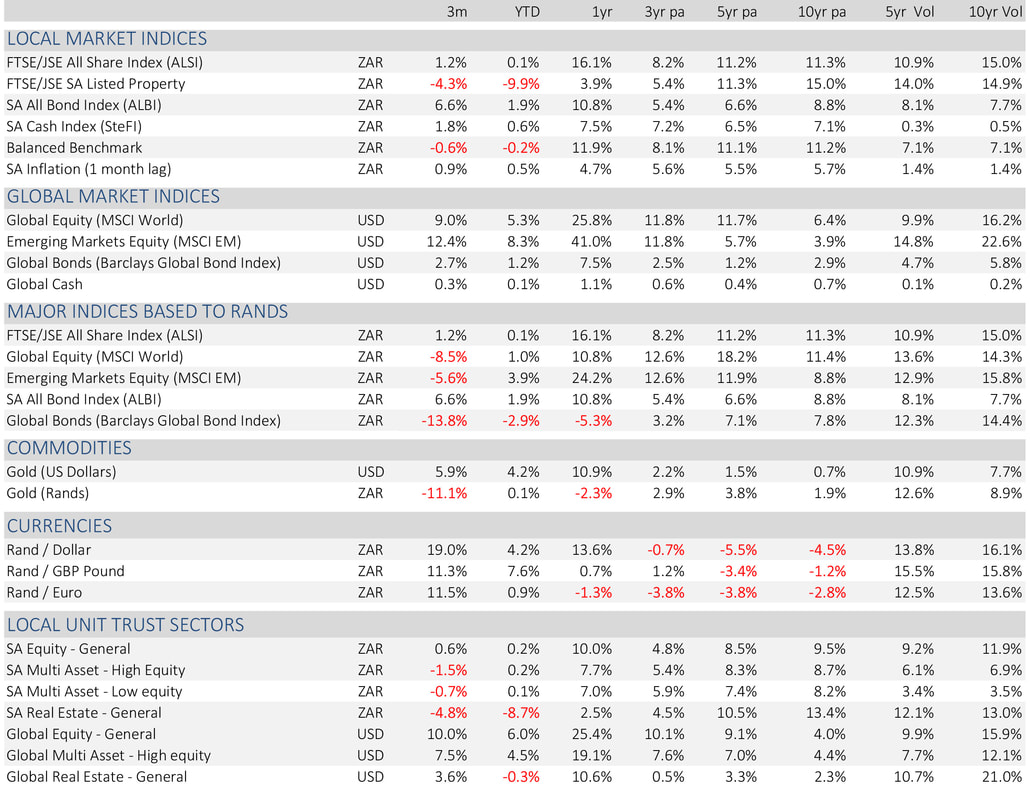

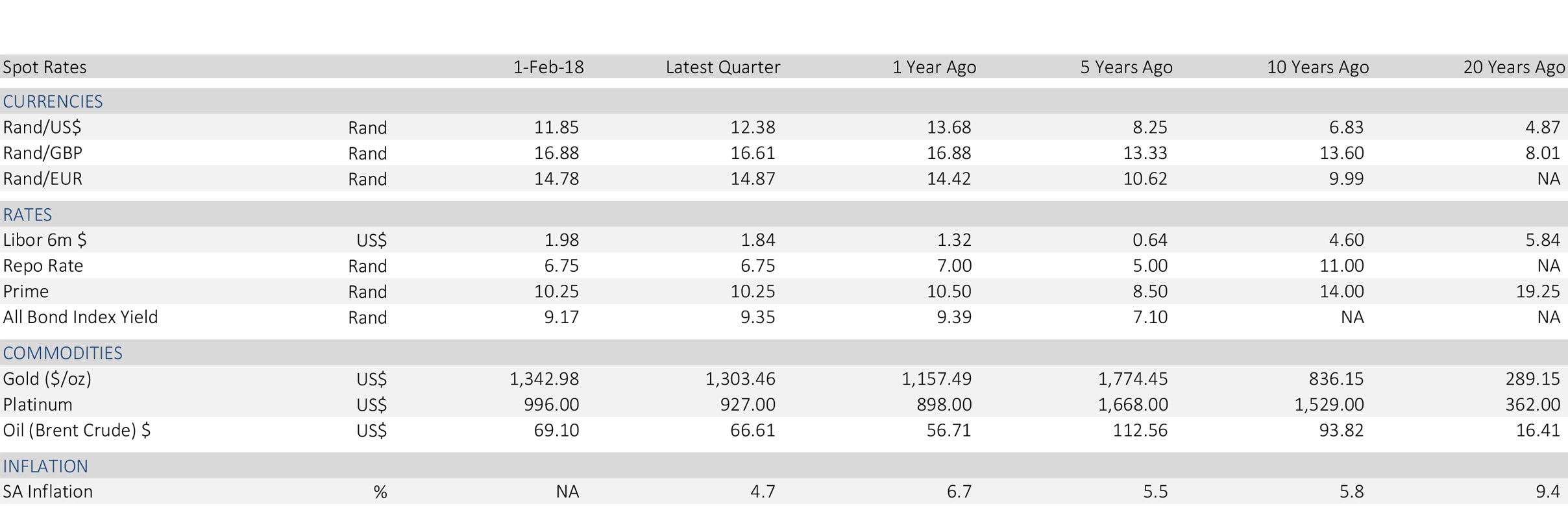

The political landscape in South Africa is changing by the day. As I write this, the State of the Nation Address has been postponed for the first time in our young democracy, the ANC National Executive Council has set up, and then subsequently cancelled an emergency meeting, rumours abound that Zuma is on the verge of resigning and uncertainty is the order of the day. The stock market, South African bonds and the currency have been volatile and everyone appears to be waiting for what is coming next. Article by: The political landscape in South Africa is changing by the day. As I write this, the State of the Nation Address has been postponed for the first time in our young democracy, the ANC National Executive Council has set up, and then subsequently cancelled an emergency meeting, rumours abound that Zuma is on the verge of resigning and uncertainty is the order of the day. The stock market, South African bonds and the currency have been volatile and everyone appears to be waiting for what is coming next. The political landscape in South Africa is changing by the day. As I write this, the State of the Nation Address has been postponed for the first time in our young democracy, the ANC National Executive Council has set up, and then subsequently cancelled an emergency meeting, rumours abound that Zuma is on the verge of resigning and uncertainty is the order of the day. The stock market, South African bonds and the currency have been volatile and everyone appears to be waiting for what is coming next. The political landscape in South Africa is changing by the day. As I write this, the State of the Nation Address has been postponed for the first time in our young democracy, the ANC National Executive Council has set up, and then subsequently cancelled an emergency meeting, rumours abound that Zuma is on the verge of resigning and uncertainty is the order of the day. The stock market, South African bonds and the currency have been volatile and everyone appears to be waiting for what is coming next. When we consider what all this means for your portfolios, we need to take a closer look at how this renewed optimism will affect South African government bonds and local equities, as well as our currency. 1. South African Government BondsRisk of downgrade One of the key headwinds facing South Africa is still the risk of a downgrade of our local sovereign debt (government bonds) to junk status. One would expect material outflows from our bond market (and pressure on our currency) if we were downgraded to junk status given that it would result in our exclusion from a range of global bond indices and global institutional mandates. In December 2017, just before the ANC conference, both S&P and Moodys provided updates on their ratings for South African government debt. S&P downgraded our local sovereign debt to junk while Moody’s decided to provide a stay of execution and announced they would hold their investment grade rating and reassess after the budget speech in February. This effectively allowed them to assess both the outcome of the ANC election as well as the new ANC leader’s ability to implement change. The three areas that Moody’s point to as areas of concern are: I. Economic indicators they consider a broad range of economic measures but are particularly looking for stronger GDP growth going forward and better fiscal discipline to halt the rapidly rising debt levels. South Africa averaged 0.8% GDP growth in 2017 and the World Bank has predicted growth of 1.1% in 2018 (compared to global growth of 3.1%). In terms of debt, the 2017 Medium Term Budget Policy Statement provided a rather grim update on the debt-to-GDP outlook with the five year projection of debt to GDP rising from 51.9% in the 2017 budget to 60.8% just a few months later, as shown in the graph below. Over time, one would hope that the change in the country’s leadership should lead to better management of the economy, but this is going to take time. II. Restructure of the State-Owned Enterprises (SOEs) Moodys raised concerns about the constant bail outs of the SOEs and the unaffordability of that continuing into the future. They pointed to governance issues within the SOEs as something they were watching carefully. In January, significant action was taken on Eskom with the entire board being replaced as well as the CEO and CFO. This was the first real indication that a power shift towards Ramaphosa had happened within the ANC. Eskom is at the heart of a number of the state capture investigations and has had considerable dealings with the Gupta family. It would not be in the Zuma faction’s interest for the existing board and executive (who were considered Zupta friendly) to be replaced. We viewed this change as the first indication of the Ramaphosa faction taking action and starting to implement change. III. Policy stability Moodys also raised concerns about the lack of policy stability in South Africa and the impact that this was having on much needed Foreign Direct Investment. At a Brand SA dinner in Davos (where the deputy president was representing South Africa at the World Economic Forum), Ramaphosa went off script during his speech and directly addressed this issue. He said, "The governing party was brutally honest with itself in terms of acknowledging some of the missteps that we have made. What are some of those missteps? There has been policy inconsistency. Many of you here are concerned about things like that. We’ve not been very consistent in our policies and we got to grips on that and said, “If we are going to grow this economy and address the triple challenge we face, (which is unemployment, poverty, and inequality) we’ve got to look at what impedes growth. All those things that are continuously impeding growth in our country: we’ve got to address them and we’ve got to address them honestly." These are only words, but this would have provided the likes of Moody’s with some assurance that policy stability has been recognised as an issue to be addressed urgently. Considering these three issues, we would be surprised if Moodys hasn’t gained a degree of comfort that the governance of the SOEs and the degree of policy stability should improve from this point forward. This should mean that while the risk of a downgrade still remains a very real possibility, the risk has reduced somewhat over the past two months. Inflation and interest rates At the moment inflation is relatively low at 4.7%. The stronger rand means that our exports are cheaper, including oil which has the effect of putting downward pressure on inflation. If you add the lack of economic growth and the fact that consumers are under financial pressure, it is expected that inflation is likely to remain under control. This should provide leeway for the central bank’s next move in interest rates to be a reduction. Lower inflation and lower rates are positive for local bond returns. 2. Local EquitiesThe improved outlook for the South African economy will more than likely have a positive effect on local “SA inc” equities. These are businesses that have all, or the majority, of their operations in South Africa and therefore their success and or profitability is closely aligned to the economic climate of South Africa. Generally what we see in times of optimism, local business and consumer confidence increases which translates to increased demand and increased investment. The JSE All Share is dominated by Randhedge stocks that generate a significant portion of the revenues from offshore operations, so investing in “SA inc” shares generally results in a higher allocation to mid cap shares 3. CurrencyApart from bonds and local equities, the changes in the political climate and the potential for a positive outcome should have a positive impact on our currency. The rand has strengthened materially against the US dollar over the last six weeks. Many have been attributing that to the Cyril effect. The reality is that while the changing ANC leadership has played a part in the rand strength, the rand strength has also been driven by a weakening dollar. The global capital markets drive movements in currency and a “risk on” trade, where investors are comfortable to take on more risk in their investments generally means more capital flowing to emerging markets which benefits the rand. But the reverse is true if we move to “risk off”. So while an improvement in the South African economy will provide assistance for a stronger rand, global capital flows can have an overriding impact. In summary, the appointment of Cyril Ramaphosa as the leader of the ruling party in December 2017 has had a positive effect on our country’s confidence and morale in the short term. It is becoming clearer through a range of actions that the power has started to shift to the new leadership and this is cause for optimism. The extent of change needed and the effort required is immense given the deterioration over the past 8 years or so, but the environment for South African assets has improved and this should benefit those assets over the medium to long term. 31 January 2018

data provided by Profile Data Analytics, Reuters and Datastream

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

February 2019

Categories |

RSS Feed

RSS Feed